I came across a (timely) PBS blog post the other day entitled: “Dan Ariely: Why our Brains Might not be Able to Resist Black Friday”. The first sentence of the post was effective in altering expectations of what the blog was about: “Well, in the best tradition of bait-and-switch, this is Duke behavioral psychologist Dan Ariely not on after-Thanksgiving shopping, but on consumerism in general, and how ill-equipped our brains may be when it comes to resisting the pitches of modern marketing.”

is a well-known professor of psychology and behavioral economics who has done extensive research on (irrational) consumer behavior. Well, in the best tradition of bait-and-switch, this post is not about Black Friday either, and nor is it, directly, about consumer behavior. While I am not aware of Ariely having studied the tendency of consumers to make purchase decisions based on immediate rather than longer-term costs, seeing the blog post reminded me of his research and led me to think that it would be possible to expand on some of his themes to explain why this is the case.

is a well-known professor of psychology and behavioral economics who has done extensive research on (irrational) consumer behavior. Well, in the best tradition of bait-and-switch, this post is not about Black Friday either, and nor is it, directly, about consumer behavior. While I am not aware of Ariely having studied the tendency of consumers to make purchase decisions based on immediate rather than longer-term costs, seeing the blog post reminded me of his research and led me to think that it would be possible to expand on some of his themes to explain why this is the case.Which gets me to the real focus of this post: business behavior. One would expect businesses to act rationally, and base equipment purchase decisions on a cost-benefit analysis and a full understanding of the total costs of purchasing and using equipment. Indeed, the concept of Total Cost of Ownership (TCO) has been around in the business world for a while, and was really popularized by the Gartner Group in relation to Information Technology, where the approach has probably seen its greatest adoption (the Gartner Group started discussing this as far back as 1987). However, the majority of businesses do not routinely apply this approach to making decisions about new capital equipment investments. For companies that purchase large amounts of equipment, such as restaurant and convenience store chains, ignoring TCO could have significant implications.

TCO is defined by the Business Dictionary as:

“Estimate of all direct and indirect costs associated with an asset or acquisition over its entire life cycle”

For a capital asset, TCO includes:

- Purchase cost

- Operating cost – including energy use and maintenance

- Disposal cost

Some take TCO further by looking at the opportunity cost of a purchase, or externalities such as greenhouse gas emissions.

Why don’t most businesses look at Total Cost of Ownership in making a purchase decision? One explanation may be that most businesses are very near-term focused, and the immediate impact of a purchase on cash flow simply outweighs a longer term view.

Another explanation is that it may be very hard to adequately measure TCO. For example, the vast majority of businesses have no idea how much energy is used by a specific piece of equipment; manufacturer specs, if available, are guidelines at best. Only a subset of companies tracks maintenance costs at the equipment level. This makes it almost impossible to estimate TCO, even if the company were inclined to do so.

Yet, the cost implications can be significant. Take a reach-in commercial freezer that might be purchased by a restaurant or convenience store chain. Assume unit A costs $4,000 and uses 19,000 kilowatt hours (kWh) of energy a year, while unit B costs $4,400 but uses only 16,500 kWh per year. Assume further that both units last 12 years and cost about $200 per year to maintain. Over the 12-year life, TCO (at an average price for electricity) will be:

Yet, the cost implications can be significant. Take a reach-in commercial freezer that might be purchased by a restaurant or convenience store chain. Assume unit A costs $4,000 and uses 19,000 kilowatt hours (kWh) of energy a year, while unit B costs $4,400 but uses only 16,500 kWh per year. Assume further that both units last 12 years and cost about $200 per year to maintain. Over the 12-year life, TCO (at an average price for electricity) will be:

Unit A – $29,200

Unit B – $26,600

Assuming both units get the job done equally well, which is the better purchase decision? For a chain with 200 locations, Unit B would save $520,000 over the life of the equipment – a fairly significant amount.

Consumers are said to be paying attention to the cost of energy in certain purchases, as evidenced, for example, by the rise and fall in the sales of SUV’s based on the price of gasoline. But this type of behavior is still not generally based on looking at the full lifetime cost of operating a vehicle. Interestingly, there are some tools available to help do just that. For example, Edmunds.com offers a TCO (with their own spin on what that means) calculator for determining the total cost of operating different models.

Consumers are said to be paying attention to the cost of energy in certain purchases, as evidenced, for example, by the rise and fall in the sales of SUV’s based on the price of gasoline. But this type of behavior is still not generally based on looking at the full lifetime cost of operating a vehicle. Interestingly, there are some tools available to help do just that. For example, Edmunds.com offers a TCO (with their own spin on what that means) calculator for determining the total cost of operating different models.

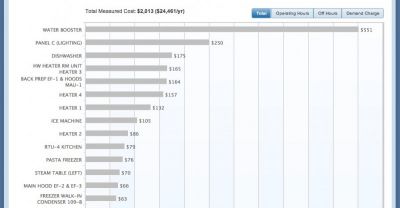

Nothing equivalent exists as of yet for businesses. However, businesses can do their own calculations – if they invest in tools to help measure the energy costs of different equipment and track the maintenance history. There are now cost-effective products available that monitor energy usage at the equipment level and generally pay for themselves fairly quickly on the energy savings alone, so that the added benefit of using the data for TCO planning is essentially obtained for free. There are also a wide range of software products available for equipment maintenance tracking and management – although few combine maintenance and energy tracking in a single package.

Nothing equivalent exists as of yet for businesses. However, businesses can do their own calculations – if they invest in tools to help measure the energy costs of different equipment and track the maintenance history. There are now cost-effective products available that monitor energy usage at the equipment level and generally pay for themselves fairly quickly on the energy savings alone, so that the added benefit of using the data for TCO planning is essentially obtained for free. There are also a wide range of software products available for equipment maintenance tracking and management – although few combine maintenance and energy tracking in a single package.

There are a handful of tools and publications available that can help with this type of analysis, at least for some types of equipment. For example, the Food Service Technology Center provides life-cycle cost calculators for estimating the lifetime energy savings associated with more efficient food service equipment, but only on a general basis. EnergyStar offers estimates for a wider range of equipment.

But these are only a starting point. Companies that are serious about using TCO to guide their purchase decisions need a combination of data and methodology. There may be work involved in setting this up, but without that it is not really possible to really perform TCO analysis.

Making decisions based on a TCO analysis is only the first step in an overall process aimed at minimizing TCO. The second, and perhaps more important step, is managing the assets themselves to reduce TCO.

For example, according to Keith Mobley, a principal consultant with Life Cycle Engineering: “The first and most critical requirement of operating best practices is to adhere absolutely to operations within the asset’s designed operating envelope… Statistical data shows that violations of this fundamental best practice account for 27 percent of all asset-related reliability problems; increase energy consumption by as much as 15 percent; and reduce useful life by 20 percent to 30 percent.” While he is referring to industrial equipment, the concept holds for virtually any capital asset.

Equally important is monitoring the performance of the equipment. Equipment that is running more than it needs to be (for example during non-business hours) is likely to wear out faster, require more maintenance, and need to be replaced sooner. If a problem with a piece of equipment, such as a compressor that is short cycling or constantly overloaded, is only found during a semi-annual preventive maintenance inspection, than that piece of equipment is likely to use more energy than it needs to, require additional maintenance, and possibly break down – at an inopportune time. Monitoring energy and maintenance costs on an ongoing basis can provide critical input to decisions regarding equipment replacement.

Adopting TCO, then, is not an insignificant step. For companies that purchase large amounts of equipment, however, the effort to develop a methodology to minimize TCO should pay off handsomely in the end. And that’s the opposite of bait-and-switch: an attractive opportunity that turns out to be worth every penny!